south dakota sales tax on vehicles

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant agency.

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

South dakota collects a 4 state sales tax rate on the purchase of all vehicles.

. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. Your businesss gross revenue from sales into South Dakota exceeded 100000. All car sales in South Dakota are subject to the 4 statewide sales tax.

While south dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one or both of the following criteria in the previous or current calendar year. You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of.

South Dakota offers exemption from car sales tax in multiple different situations including. With local taxes the total sales tax rate is between 4500 and 7500. Category Exemption Status.

Scroll to view the full table and click any category for more details. The state sales tax rate in South Dakota is 4500. South Dakota has recent rate changes Thu Jul 01 2021.

Motor Vehicle Sales or Purchases. Select the South Dakota city from the list of popular cities below to see its current sales tax rate. Any motor vehicle sold or transferred that is eleven or more model years old and which is sold or transferred for 2500.

The tourism tax is used for the promotion of tourism in South Dakota. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax. The average sales tax rate on vehicles across the state is 5814.

That way you dont have to deal with the fuss of trying to follow each states. In addition for a car purchased in South Dakota there are other applicable fees including registration title and plate fees. South Dakota doesnt have income tax so thats why Im using sales tax.

However if purchased by an out of state business you will need to show proof of tax paid to your local Department of Revenue office. No excise taxes are not deductible as sales tax. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees.

45 Tourism Tax Applies to certain lodging and amusement services. However some state excise tax is deductible as personal property tax on Schedule A itemized deductions in place of car registration fees. Applies to all sales of products and services that are subject to the state sales tax or use tax if the purchaser receives or imposes a sales tax or use tax.

Different areas have varying additional sales taxes as well. Can I import a vehicle into South Dakota for the lone purpose of repair or modification. Any motor vehicle transferred as part of.

This means that depending on your location within South Dakota the total tax you pay can be significantly higher than the 45 state sales tax. 36-Franchised new motor vehicle dealer pays 4 excise tax on the manufacturers suggested retail price of a new vehicle and licenses motor vehicle-42-Dealer titles option of licensing used vehicleboat and does not pay excise tax07. 45 the following tax may apply in addition to the state sales tax.

In addition to taxes car purchases in South Dakota may be subject to. South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1814 on top of the state tax. Ohio is the most recent state to repeal its tpp tax in 2005.

Purchasers of most new and used motor vehicles trailers semitrailers and motorcycles owe a 4 motor. You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership. If you are interested in the sales tax on vehicle sales see the car sales tax page instead.

Though you can find automotive offerings spread out in smaller towns you may have to drive into major cities of South Dakota to find car. Average Local State Sales Tax. Dealers are required to collect the state sales tax and any applicable municipal sales tax municipal gross receipts tax and tourism tax on any vehicle product or service they sell that is subject to sales tax in South Dakota.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. The car dealer will follow the sales tax collection laws of their own state. Items picked up at the sellers location are subject to sales The state of south dakota relies heavily upon tax revenues to help.

Counties and cities can charge an additional local sales tax of up to. The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45. 2 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases.

4 Motor Vehicle Gross Receipts Tax Applies to the rental of motorcycles cars trucks and vans for less than 28 days and the rental of certain trailers for 6 months or less. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Car Dealership Areas In South Dakota.

In addition to taxes car purchases in south dakota may be subject to other fees like registration title and plate fees.

Lakota Country Times Oglala Lakota County Gets Police Vehicles Native American News Native American Indians Country Time

Car Sales Tax In South Dakota Getjerry Com

Cars Trucks Vans South Dakota Department Of Revenue

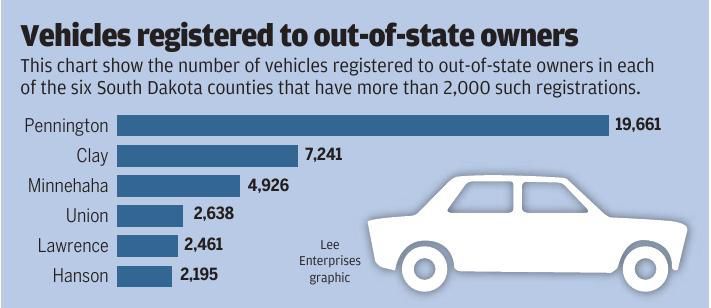

58 334 Out Of State Vehicles Registered In South Dakota Local Rapidcityjournal Com

The Oldie Dodge Ram Sport In Fire Red What A Turn On Hahaha Afiches Publicidad

Car Sales Tax In South Dakota Getjerry Com

Car Sales Tax In South Dakota Getjerry Com

Nhl Toronto Maple Leafs 2 Pc Carpet Car Mat Set 17 X27 Nfl Car Car Mats Car Floor Mats

Pin On Jerry S Chevrolet Of Beresford

10 Most Innovative Camper Vans Motorhomes 2020 2021 Youtube In 2021 Camper Van Motorhome Camper

What S The Car Sales Tax In Each State Find The Best Car Price

Check Out Our Inventory Eastcountypreownedsuperstore Cardealership Cars Carsearch Inventory Preowned Usedcars Vehi Car Dealership Car Search Used Cars

2009 Ford Edge For Sale In Frankfort Il Offerup Ford Edge Ford Frankfort

Pin On Form Sd Vehicle Title Transfer

Used Truck Shopping Come Drive This 2008 Dodge Dakota Sxt 4x2 At Stuart Powell It S A Local Trade In With No Accidents And Car Ford Used Trucks Used Ford

New 2016 Kawasaki Krf800fgf Atvs For Sale In Indiana 2016 Kawasaki Krf800fgf Teryx Base Kawasaki Heavy Industries Atv Kawasaki

Caddyshack Golf Carts Mini Mustangs Cobras Raptors Golf Carts Golf Car Golf

Klassen Mercedes Sprinter Custom Auto

2018 Michigan License Plate Dby 9843 On Mercari License Plate State License Plate Car Plates